SUMMARY

Learning from the failure of their first beauty startup, SUGAR Cosmetics cofounders Vineeta Singh and Kaushik Mukherjee capitalised on customer feedback and market research to create a formidable D2C beauty brand

The cosmetics brand has carved a niche in the INR 600 - INR 700 price segment, balancing retail expansion with a D2C-first approach for its products built around trending themes and Indian skin tones

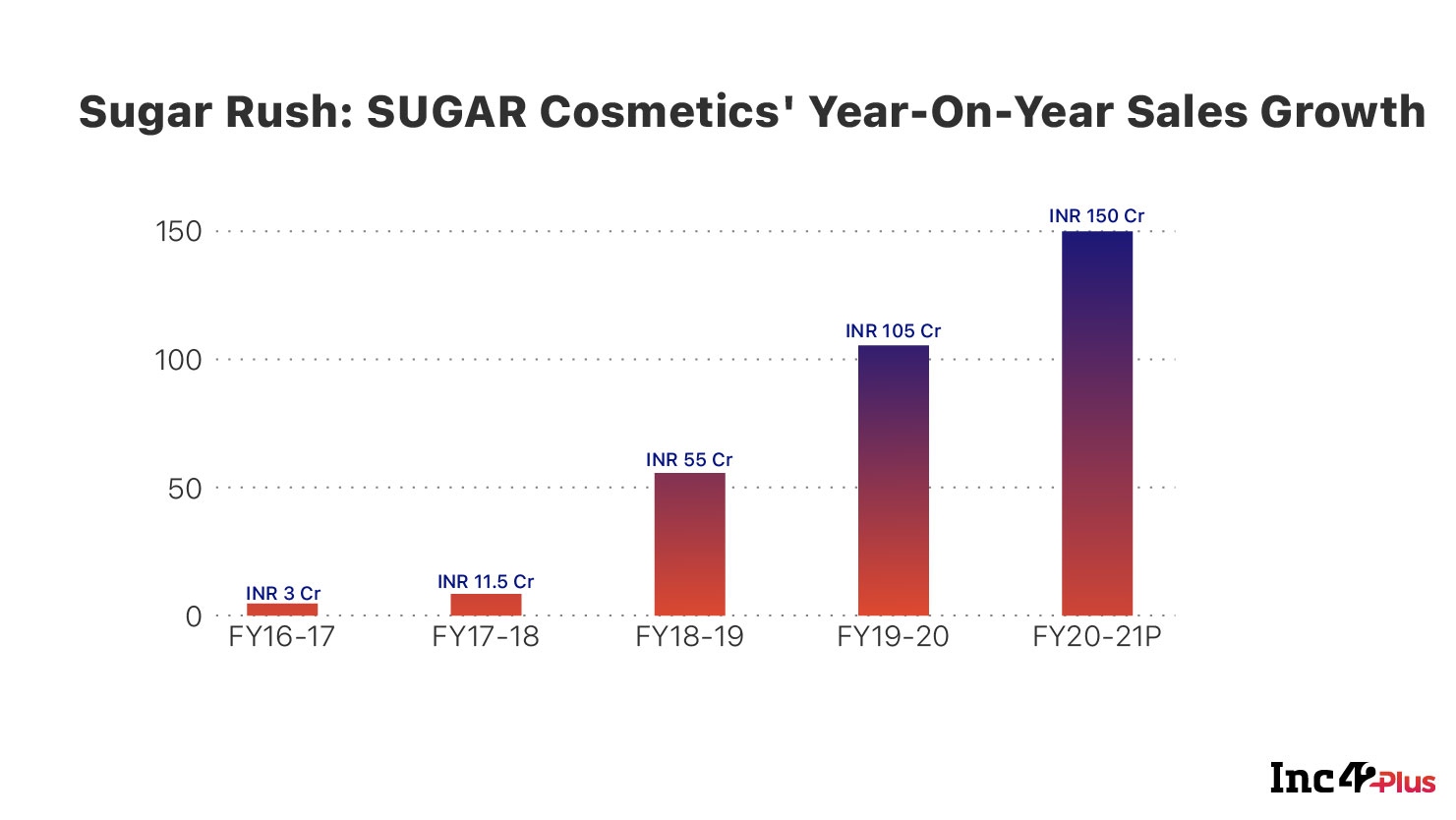

SUGAR crossed INR 100 Cr in net revenue for FY2020 and with revenue share from its native D2C app and website growing to 65% in August 2020 from 35% before March 2020

India's D2C Rush

As more and more consumer brands go digital to reach customers faster and carve a unique identity, India’s direct-to-consumer (D2C) moment is well and truly here. With thousands of brands competing in the D2C space, will this be the future of India’s retail market?

“Pour yourself a drink, put on some lipstick, and pull yourself together,” said Elizabeth Taylor.

For women, lipstick is not just a cosmetic product, it connotes confidence, fearlessness and independence. A woman’s love for lipstick goes way back to 3500 BC when for the first time the queen of ancient Sumeria coloured her lips using white lead and crushed red rocks. The red lip paint was then popularised by Egyptians including Queen Cleopatra, who crushed red cochineal insects to create the deep shade of red that epitomises lipsticks. Later by Queen Elizabeth and then by Hollywood icons such as Marilyn Monroe, Audrey Hepburn and Elizabeth Taylor.

For Vineeta Singh too, CEO and cofounder of SUGAR Cosmetics, the fascination with lipsticks comes because it is an instant mood lifter. “Like most women, I wear lipstick for myself — it makes me feel more confident and instantly lifts up my mood no matter how low I feel. The joy of discovering a colour that brightens you up is absolutely incomparable!,” says the cofounder of SUGAR Cosmetics, a fast-rising D2C brand in the cosmetics category.

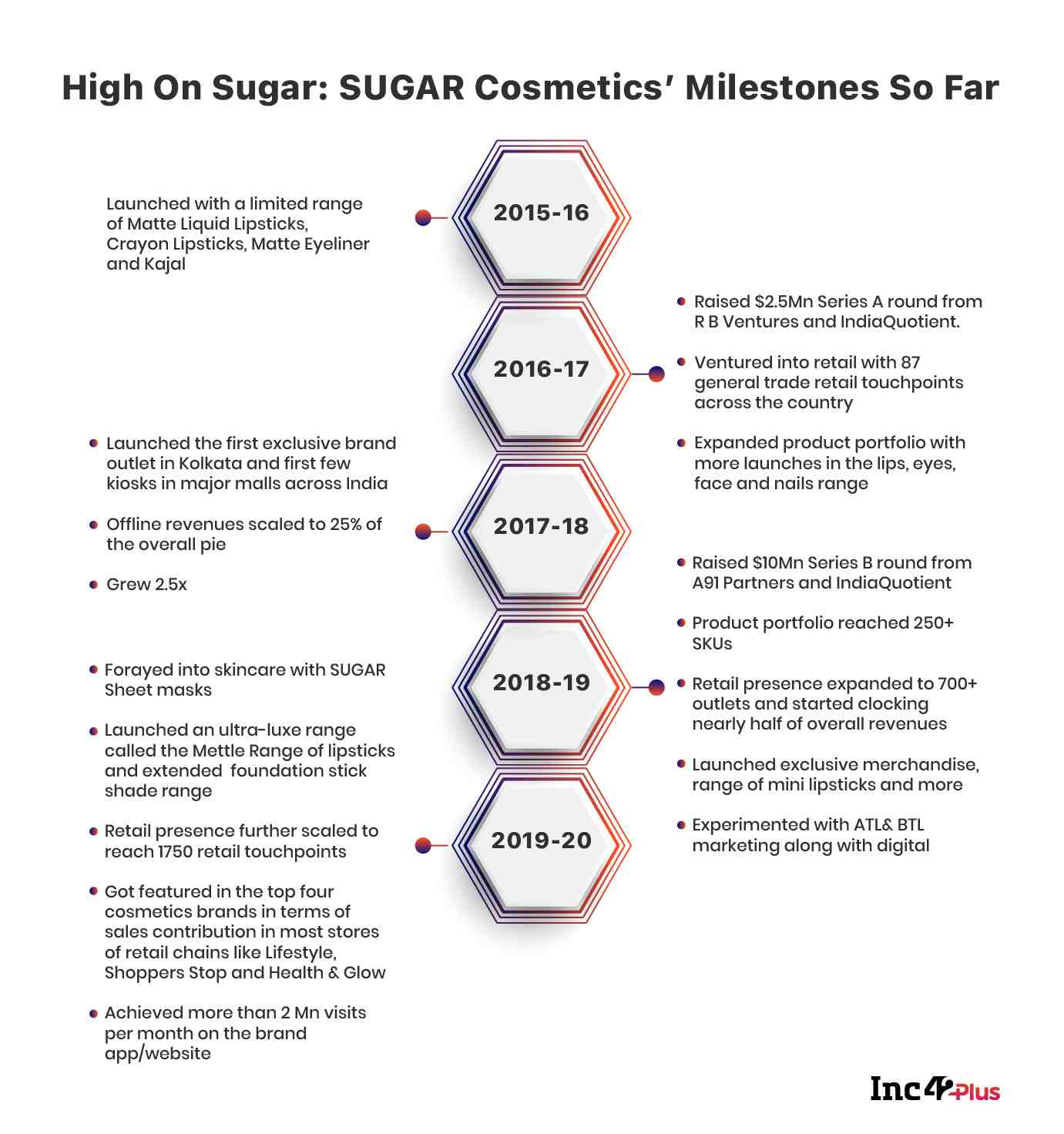

Vineeta had always felt very strongly about building something with women as the core target audience and that’s how SUGAR Cosmetics was born in 2015, with just two products — a black kajal or kohl and a black matte eyeliner. The eyeliner went on to become a bestseller and paved the way for SUGAR to expand its stable to 450 stock keeping units (SKU) today. The success has netted SUGAR revenue of INR 100 Cr for FY2020 with more than 650K followers on Instagram, 200 Mn impressions across all social media channels and 2 Mn monthly visits to its website.

“Beauty is freedom – from being judged. Freedom to experiment. To be. Some beliefs are beyond targets and numbers,” says Singh.

She recalls how SUGAR cofounder Kaushik Mukherjee and she never stopped to think before launching 22 shades of their bestselling Ace of Face Foundation Stick for all skin tones. “Expectedly, some sell more than the others but I’ll tell you this — every single shade in that range is a source of pride and joy to my team and me.”

The Journey Before SUGAR

Like any entrepreneurial journey, SUGAR did not happen easily for Singh and Mukherjee. Vineeta counts their laser sharp focus as a key success factor. After spending six years at IIT Madras and IIM Ahmedabad, Singh directly jumped into entrepreneurship. She even declined an investment banking job offer with an annual pay of INR 1 Cr — which doesn’t regret, despite endless mistakes along the way. Mistakes not just with respect to SUGAR, but also a company which she had started with Mukherjee (whom she met in B-school) in 2012 and was shut down within three years of operations.

It was the couple’s first venture and Mukherjee quit his job with McKinsey & Co to join Singh for the D2C beauty subscription startup. “I remember, as a naive new B-school grad, making many women-centric business plans — lingerie, athleisure, beauty — on paper. It was the idea of beauty subscriptions that actually got us all excited. The beauty industry was expanding and moving towards a younger demographic that engaged on digital media to authentic products and content – the perfect D2C,” recalls Singh.

Moving On With The Same Zeal

Though the startup didn’t click, it allowed SUGAR founders to connect with the target audience, create a closed-loop feedback gathering system and the ability to sell 200+ products each year to 100K+ women. This is when it first hit them that there was a shift underway in the industry and a white space that nobody was serving.

“We plotted all the lipsticks available in the market on a price ladder and realised that the market was pretty polarised. At one end, there were extremely popular mass-market products at the INR 225 – INR 299 range, hardly a few in the INR 450 – INR 500 range and then there was a direct price jump to INR 1000+,” she says.

Something seemed off and there was a clear opening for another lipstick brand in the INR 600 – INR 700 range, that had higher colour payoff and lasting power, and in shades specially crafted for the Indian skin tone.

And, that is how SUGAR was born!

But ask Singh why the name SUGAR, she laughs, “This one’s a well-kept secret for now. What we can share is that while shortlisting names, someone in the team commented on how “makeup gets us high” which was followed by a wisecrack about “the name SUGAR can give us a rush without the calories.” The name was included in the final list of five names that they ran a poll with. SUGAR topped the polls among the target group of 18 to 25-year-olds with a very interesting feedback that “it didn’t sound like a new brand” and that sealed it.

The Two Pillars Of SUGAR

Through the process of identifying the whitespace in the market, SUGAR also realised that the “market” itself was changing and expanding every day. The target group that it was reaching out to had become digital-first and were opinion leaders who would not fall for a celebrity endorsement alone. The new-age Indian woman was not gullible and trusted peer reviews more than a flashy ad. They also viewed makeup as a form of self-expression and a confidence booster and this opened up the market for new themes – matte lipsticks, colour payoff, lasting power and shade-suitability to the Indian skin tone.

“No other brand was simply doing enough to address these. That was all we needed to know and believe,” Singh says firmly.

The startup’s belief resonated with 18 to 25-year-olds. The team kept their faith in the product — what they said no to was more important than what they said yes to. “We didn’t set out to compete on price, we set out to create a better lipstick – and remembering that made all the difference. Not only did our lipsticks have higher pigmentation, last longer – but they also had a distinct bold visual identity. Black. Matte. Square – You’ll instantly recognise a SUGAR lipstick when you see one,” Singh adds.

Initially, Singh and Mukherjee patched together some savings till they had their first formal investor. They also admit that over the years they have borrowed money from batchmates, friends and family just to survive and live to fight another day. “Of course, it took us years to find the elusive “product-market-fit” but every hit and miss has shaped SUGAR to what it is today,” she said.

SUGAR as a brand has always had an anti-establishment air about it, more creator-led than celebrity-driven voice in a cluttered market where brands spend more time talking about discounts than the power or beauty and cosmetics. When we asked Vineeta about competing with well-known brands, she says that anybody who sells cosmetics is competition for SUGAR but the startup doesn’t invest much effort in thinking about how to “deal with” the rivals.

“We just focus on what we do best: listen to the customer, keep innovating on product and be obstinately clear about not taking shortcuts that grow sales at the expense of the brand,” she said.

D2C Not The Chosen Way But The Only Way

While these days D2C brands are becoming increasingly commonplace with the entry of traditional companies as well, when SUGAR began in 2015, it did not have to choose that route. It could have chosen to launch on ecommerce marketplaces like many other brands too, or gone straight for the retail pie. So why choose the less-travelled (at the time) D2C path ? “Let’s be honest here — nobody gives a new kid on the block a chance with a guarantee of revenues. Shelf-space is super precious in India and the only way for us to prove product-market fit and demand was to do the job ourselves in the first two years of the brand,” Singh opens up.

So in a manner, D2C was the only way for the cosmetics brand. This helps brands control the narrative more tightly, Vineeta believes and get closer to consumers. In India, large D2C brands cannot be built without partner channels — either online or offline. But roots need to stay digital, so products need to be launched first on the native platform — like in the case of SUGAR — with exclusive BYOB (Build Your Own Box of SUGAR products) offering will be available on through our own channels,” she continues.

Even SUGAR was digital-only till 2017 through its own website and other leading marketplace partner, but cofounders always believed that a retail play is imperative to build a large business. By early 2018, SUGAR slowly made inroads into general trade and large-format retailers in malls. To their surprise, the first exclusive store happened just by chance. “Somehow we learnt of this store in Kolkata’s Forum Mall that was vacant and right in between a popular global makeup brand and a premium skincare brand. We caved,” she says.

Since then, the company has added over 40 exclusive brand outlets or kiosks and has a presence in over 1,750 retail touchpoints.

The vast network is monitored from the company’s central warehouse in Mumbai, which SUGAR owns and operates, besides a third-party logistics warehouse in Delhi. While Blue Dart, FedEx, ExpressBees and others handle deliveries, coordination for shipping and returns is done by a team at the HQ in Mumbai, which has real-time data and tracking for faster turnaround times.

SUGAR is currently present in retail chains such as Shoppers Stop, Lifestyle, Central, Health & Glow, NewU, who receive products from the company’s logistics partners, just like at its standalone retail stores. When it comes to online marketplaces, SUGAR has partnered with Amazon, Myntra, Flipkart and Nykaa. It operates on the Amazon Seller Flex model, where the Amazon logistics partners visit warehouses to pick up shipments and deliver it to consumers. And finally for its native D2C channel, products are shipped directly to customers in over 18K postal codes all over India through logistics partners.

Hustle Bustle And Behind The Scenes

Singh talks proudly of her team and describes what goes on behind the scenes at SUGAR as a neverending mix of hustle and hunger with equal parts humility and humour thrown in.

“We are just a young team that loves to punch above our weight and make the “industry” sit up and take notice,” she says.

With retail rapidly becoming a significant part of SUGAR’s business over the last two years after the online-only approach (more on that later), the brand has also attracted the slightly older millennial target group of 25 to 34-year olds, but its primary focus continues to be 18 to 25-year-old girls and women.

Curiously, influencer marketing has been key in tapping both sets, but more than anything SUGAR has banked on the power of content. “I think building a brand involves building a voice before you build sales. And a voice is only as powerful as the content it articulates – consistently and clearly – across time, geography and channels. Over time, we have expanded to various ATL (billboards/radio/newspapers) and BTL (SUGAR Makeup Station) initiatives but still continue to be content- first,” she says.

Like most other D2C brands, performance marketing and a focus on bottom of the funnel metrics like add-to-cart and conversion rate have helped the brand scale rapidly. Vineeta says the company found a larger value unlocked by investing in content creation and earned media strategy to organically widen the top of the funnel and generate high-quality traffic.

In the past few months, with consumers showing high engagement in smart content, SUGAR has doubled down on creating more touch points and expanded to longer videos and long-form articles. It seems to have paid off well. “Never had we imagined that we would get a once-in-a-lifetime opportunity to rack up online sales with such frugal customer acquisition costs while the retail slowly recovered,” the cofounder notes.

In June, the company crossed its previous highest sales in a month on its website and app, and then raced past that number in the first 15 days of July.

Currently, SUGAR clocks 60% of all online sales on its app and this was just 10% in February. So for this startup at least, Covid-19 has proven to be a D2C catalyst from March till now.

How SUGAR Leaped The Covid-19 Bump

But that was not the case in April, just like others.

“We had an inside joke about how we had caught up with the market leader in the segment as everyone was at (near) zero revenue! That month was mostly spent on Excel calculating burn and runway metrics until we could recite them in our sleep.”

Managing burn meant drastically reducing fixed costs overnight. All discretionary spending like performance marketing ads were pulled, discussions were initiated with business partners for extended credit periods and most importantly — the pay cuts were offset by employees being offered 4X the forgone amount through ESOPs.

“Thanks to the collaborative effort and sacrifices of the team, we played as one and battled this together. Even our retail store colleagues pitched in by clocking brisk sales via their WhatsApp groups and networks to help the company generate revenues during the lean months,” says Singh about the early days in the lockdown.

Once the sale on non-essential items resumed in May, the speed of recovery caught SUGAR by surprise. The initial challenges were mostly operational — keeping the warehouse functioning and ensuring a safe environment. The team started focussing more on building a transparent and robust communication strategy around delivery timelines and operational challenges. The company also banked on augmented reality tools in its online store in addition to shade selectors and high-quality video and image assets to transition seamlessly to the new normal.

“We expect to get back to our pre-Covid monthly net revenue run rate by next month and close this FY with a 50% jump in revenues over last year,” Singh projects.

The company is also currently in advanced talks to close its next round of funding and expects to sign the term sheet in the next few weeks. Its core focus with the funds will be on scaling up the revenues from the app to 60% to 80% of all online revenue, with India being the primary market, besides a minor focus on US and Russia as international markets — not more than 10% of revenue, says Singh. And in India, the focus has to be split between retail and online as that’s the nature of the market, which demands funding from investors.

“If some reports are to be believed, around 95% of trade still happens offline in India. In this market dynamic, we don’t see an online-only or pure-play D2C being able to grow the brand and its award-winning product range to its fullest potential,” Singh added.

Singh says she and the SUGAR team takes courage from the tough times when products would be out of stock and yet a new batch could not be ordered due to cash crunch — or even the gaps in knowledge such as not understanding the conversion funnel, tinkering with the dashboards to get real-time revenue and inventory visibility, all of which came in due time for the company, which prides itself on learning on the go.

“That’s the beauty (pun unintended!) and the thrill of jumping into the deep end of the pool – sometimes, we just have to figure out how to swim along the way,” Singh quips.