SUMMARY

While April and May were the dark months when digital lending was at a standstill, the light at the end of this tunnel is not close yet. Only a few lending companies will be able to survive the journey

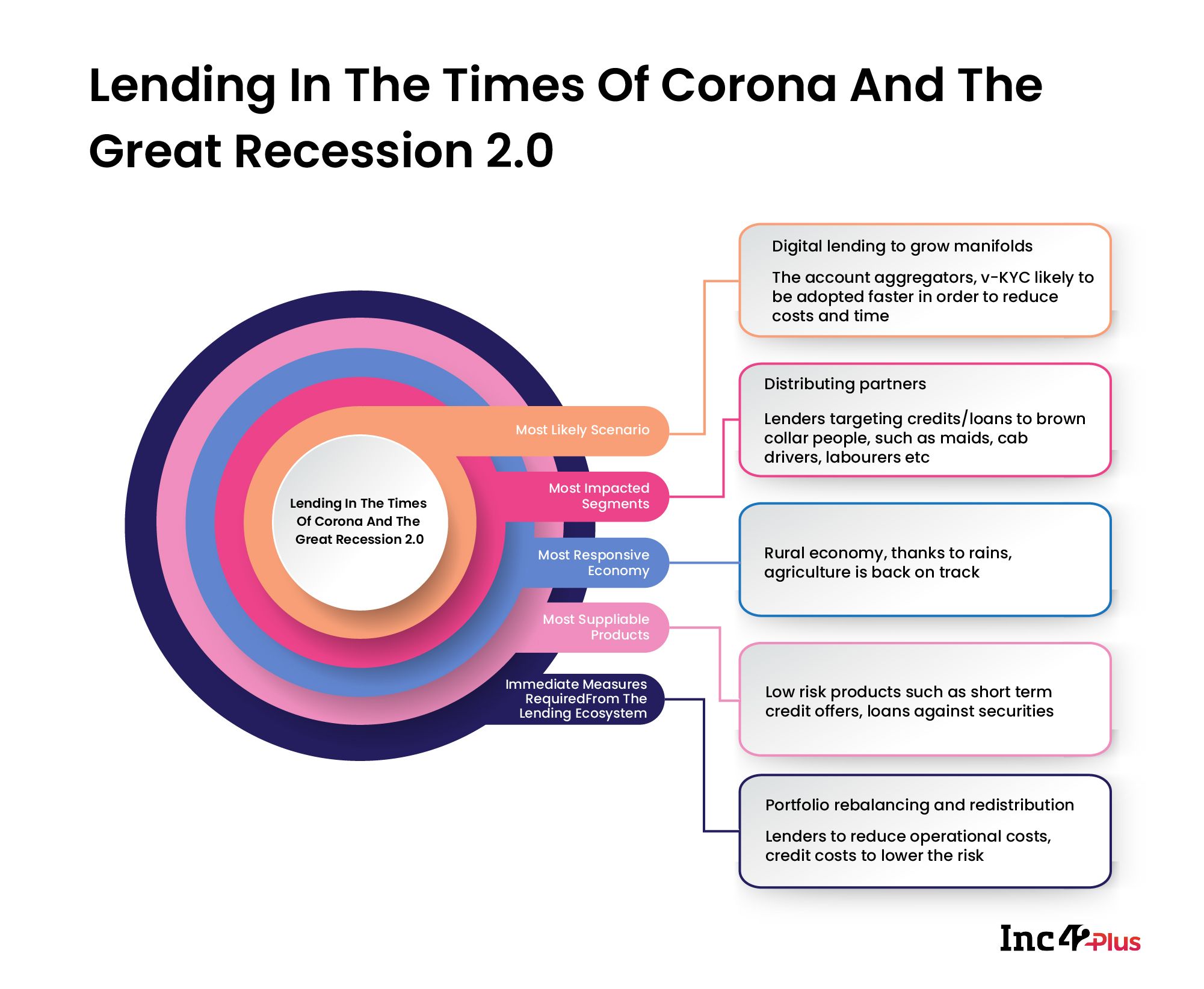

In the post-lockdown market, lenders have greatly tilted their operations towards short-term credit, working capital loans against security with the moratorium worsening matters from a business standpoint

With banks and NBFCs, busy in portfolio redistribution in less risky segments, the credit supply chain for many SMB lenders has been disrupted and only just recovering six months after the lockdown

India's Digital Lending Reset

India’s digital lending sector is currently in a reset mode as the contracting GDP, moratorium, & Covid-19 has forced companies to adopt digital, review credit models & more. This playbook takes a deep dive into the challenges and new pathways adopted by digital lending startups for survival and scale!

Be it the contraction of the GDP or the spread of Covid-19, the curves are simply not flattening. In both cases, the unwillingness of the Indian government to accept facts on the ground and failing to take adequate measures at the right time or rushing into decisions have impacted India severely, with the country among the worst-hit nations in Covid cases as well as in terms of the economic downturn.

India’s quarterly GDP growth for FY 2020-21 fell by 23.9%, which is the worst among comparable economies. And while India’s finance minister called this decline an ‘Act of God’, the fact is that the GDP growth rate has been on a sliding slope since 2016 when India observed a 0.26% increase from 2015. Fitch Ratings Ltd has now slashed India’s growth forecast for FY21 from -5% to -10.5% which Goldman Sachs estimates at 14.8%.

All this talk about GDP is not about spelling doom but in fact the precursor for the uncertainty that has hit one of the most crucial sectors in the country, the lending market. Not only are millions of small businesses dependent on credit access, but even individuals had to turn to loans to survive the pandemic. The digital lending wave in consumer loans is trickling down to B2B lending too. And that’s where most of the developments are happening if lenders manage to recover.

While April and May were the dark months when lending was at a standstill, the light at the end of this tunnel is not close yet. Only a few lending companies will be able to survive the journey through darkness, many experts believe, including Mithun Sundar, CEO of Lendingkart, one of the largest working capital lenders for the MSME and SMB segments.

After a detailed analysis of India’s D2C rush, India’s healthtech boom, and more through our member-exclusive Playbooks, Inc42 Plus is now diving into the most topical issue in the financial services market with a 360-degree coverage of this most impacted industry i.e. lending.

Our India’s Digital Lending Reset Playbook will deep-dive on the shifting revenue models, the moratorium impact, the supply chain in credit, the digital future for B2B lending, and the impact of the account aggregator system.

Survival Of The Fittest In India’s Lending Market

“There were about 10,000 registered NBFCs in March. This has now come down quite substantially, because a lot of them have not been able to defer the crisis, as their quality of lending was not as prudent as it should have been in the earlier stages,” – Lendingkart CEO Mithun Sundar

The common theme in our conversations with the lending startups and digital NBFCs has been that survival will be the biggest fight and most of the energy will go towards ensuring a steady flow of income to keep the business ticking, instead of big leaps of growth. “Covid-19 will separate the winners from the losers in terms of who survives in this market and will result in a much higher flight to quality of the capital,” the Lendingkart chief added.

On the demand side, the moment of growth will be when India recovers, and many believe it will be a credit-led recovery and nothing else due to the paucity in income growth. And so, because people will need credit in order to be able to recover from a downturn of this kind.

There will be mergers and acquisitions as part of the consolidation wave in lending too. Large-cap companies are also expected to venture into space if the typical players remain cautious on loan disbursal.

As the ‘Great Recession 2.0’ rises amid the pandemic, what are lending startups doing to tackle the new reality?

Lenders Get Back To Life

“The portfolio rebalancing and redistribution has already started happening, which means that overall the credit disbursements have started picking up,” said Uday Somayajula, cofounder of ePayLater.

April, May and for the most part of June, digital lenders had almost shut down services, simply hoping things would come back to life a few months down the line. The supply was completely broken with lending partners having no idea of getting their returns and EMI repayments which led the government to introduce the moratorium to give borrowers immediate relief. The worst part was there was nothing anyone could do about it.

Saurabh Jhalaria, head of SME lending at InCred recalled the lockdown days of the pandemic when supply was down by 90-95% and the industry was still figuring out what moratorium means for them. “Many didn’t have effective work from home processes. Many hadn’t built the alternative models regarding the fulfilment of loan obligations. The demand too had reduced. The borrowing needs were mostly coming from corners of the society that were already in a debt trap. There, people needed money to pay for their daily expenses. And, that’s not really a loan product that would go well with lenders,” Jhalaria told Inc42.

Like many other industries, the lending startups too are slowly coming back on track. Companies claim to have regained anywhere between 30%-98% of the pre-Covid revenue, depending on their offerings and segments they lend in.

For instance, InCred, which is a B2C and B2B loan provider, claims to have gained 85% of its pre-Covid-19 business. While MSME lending startup ProgCap claims to have regained 70-80% of the business. Offering credit-line products, MoneyTap has regained 65-70% of its business which was reduced to 10% during April-June, cofounder Anuj Kacker told us.

So, in the changing times, what are the new challenges for lending startups?

Cutting Down The Operational Cost

The model has changed. The risk is higher and in order to survive, lenders will have to find ways to reduce operational cost, believes InCred’s Jhalaria. Credit costs that were modeled based on pre-Covid analytics-based scores and the trend of account might behave very differently in the post-Covid era. “Since the credit cost is going to go up for most, there is a very sharp need to reduce operating costs to compensate for the increase in credit cost,” he added.

There are few segments that have actually benefited at the ground level because of the overall disruption in the market. Like edtech, the kirana segment is doing great as stores look for working capital loans to fuel hyperlocal demand in the metros, said Uday Somayajula, cofounder of ePayLater.

“Even on our platform, we saw demand spike at a customer at a kirana level going above 80% to 160% on an average. So there is a huge demand that has built up over this period for the kirana business and in turn for the credit that the kirana is now demanding. So that way, it’s been a very, very positive trend both of these things,” Somayajula added.

For a bank or diversified NBFC, the portfolio distribution will change and they will now focus more on adding and distributing assets in less risky segments. The redistribution has already started and it is on the way. There are certain areas where it will eventually take a long time for the recovery to happen. Products like long-term credit and unsecured loans would be that much more elusive in the days to come in the self employed and the salaried class because of the uncertainty in the job market. So those products might take longer, while secured lending is expected to pick up faster in certain sectors.

Even as most lending startups played it safe during the lockdown and RBI-imposed moratorium period, many succeeded in raising equity or debt funding in H1 2020 despite the crisis. Along with sectors like edtech, healthtech, investors have stood by lending as well, given that demand never went away, but only supply froze temporarily. This is also essentially because India has remained a consumer-centric market, where loans are driving purchasing power.

The Moratorium Blues Hit Lenders

Looking at the complete devastation in the market in April and as a relief measure for borrowers, RBI had introduced a three-month moratorium, which was to end in July, and then extended it by another three months.

While borrowers had some relief, lenders, however, feel that the implementation was faulty and there was not much clarity over the immediate impact it would have on the credit supply chain. This is perhaps the biggest dangling sword on the heads of lenders today. If the RBI extends the moratorium further or if multiple currently ongoing court cases rule against lenders charging interest for this moratorium period, then the lending sector will have an even bigger crisis on its hands.

Along with other challenges in the way for lenders, our Playbook will delve into the moratorium impact on lending startups, and how they are planning to restructure EMIs for consumers and businesses that have availed the moratorium.

How “Digital” Is B2B Lending

On the consumer side, digital acquisition is the name of the game. That’s because it is relatively easier to track an individual’s data through CIBIL and Experian scores, but B2B lending is a different ballgame altogether.

Not only is there a lack of data availability for many businesses, but also little to no transparency. Covid-19 has forced B2B lending startups and NBFCs to adopt e-Sign, e-Mandate and video KYC which were conducted physically earlier. But that does not solve the problem of SMEs not being digital savvy and lacking in terms of adequate historic data to improve credit access. So to what extent the B2B lending has gone digital?

In this article, we will dive deep into the pre-Covid B2B lending market and post-Covid landscape, where companies are fast transforming and building full-stack SMB lending tech.

Five Emerging Digital Lending Startups

Despite the several hurdles and data infancy in many business sectors, India’s lending market is one of the most vibrant in the world. In fact, some would say it is due to the variety in business models and practices that Indian startups have had to find novel ways of assessing risk when lending. On the other side of the spectrum are ultra-innovative consumer lending models that are using everything from social media data to digital transaction history to lend to individuals.

Uniqueness matters even in the new-age lending market. So we have handpicked five emerging digital lending startups that have the most unique models and which are looking to tap into the right sectors and segments in the post-pandemic world.

Can Account Aggregator Change The Face Of Lending?

Yes, data is one of the biggest hurdles in easy access to credit for many individuals and businesses, but that’s about to change soon with the account aggregator system filling in the gaps.

While the NITI Aayog along with iSPIRT Foundation has published a discussion paper on account aggregators, lenders have more fear than hope from the system. They are wary of the charges that could be levied by account aggregators and even a cut higher than 1% may not be viable for many lenders. At the same time, some lenders have also raised up implementation issues that could make account aggregators insignificant despite it being a revolutionary idea on paper of consent-based data acquisition.

Will Account Aggregator add more hurdles to lending instead of removing them?

The NPA Rot Gets More Rotten

Come March 2021, banks will nervously await the industry-wide NPA figures. As and when they are revealed, the NPAs will further force banks, NBFCs towards consolidation as given the economic climate, NPAs are expected to rise significantly.

However, disclosure or no disclosure, banks, NBFCs, and distribution partners are currently facing the issue too. These stakeholders have called the RBI to take essential steps in this regard to easy collection/recovery and reduce the risk of lending. To add to the worries of digital lenders, the haphazard and staggered unlocking of some states has led to imbalanced growth. Certain high-value regions are still not open for business.

Having emptied its hands already and with the government unwilling to add more relief funds besides what has been announced already, the RBI too has stopped tinkering with the repo rate and reverse repo rates, which have resulted in inflation rising. With the moratorium still biting at their heels, what are the options for lending startups and will the RBI pull off a rescue act in some form to mitigate the NPAs?

Read the fascinating turns and twists in the lending market in our latest playbook.