SUMMARY

OYO reported consolidated revenue of INR 6619.26 Cr in FY19

The hospitality giant operates in over 800 cities in 80 countries, entering many new markets in 2019

OYO’s China business contributed a total income of INR 2134.4 Cr in FY19

What The Financials

Inc42 unveils and deciphers all the important financial metrics of Indian startups across industries. Find out revenues, unit economics, profit & loss and all the important financial metrics to judge how the startup will perform in the coming years.

There are a few things which come along with great success — responsibility to the investors and customers, and the glare of the public eye on everything one does. Just ask Ritesh Agarwal, who turned his idea for budget hotels into a global success story with a valuation of nearly $10 Bn. From the business idea of a 19-year-old founder and through seven years of expansion, OYO has reached the point of its biggest scrutiny. In part, because of its sky-rocketing valuation with massive funding rounds and also for its ambitions of revolutionising real estate and hospitality in India after the dramatic events at WeWork in 2019.

Beyond the high-paced growth and huge amounts of capital raised, many observers have brought up similarities between WeWork and OYO, with regards to the business models. Amid Intense scrutiny, and its search for the path to profitability with restructuring, layoffs, there are also questions on “toxic” culture at OYO, protests from hotel partners, police complaints and much more. Public eye, indeed.

In the Indian context, the hotel protests against OYO began at the end of 2018 and continued through most of 2019, which really never gave OYO any respite from the publicity around its terms and contracts with hotel partners. By the end of 2019, OYO was under intense pressure to deliver on its ambitions but began 2020 with mass layoffs and more negative press around its work culture.

While it will be interesting to see the impact of these troublesome factors on OYO in 2019-20, the company has already reported higher losses in its financials for the year ending March 31, 2019.

According to filings accessed by Inc42, OYO parent Oravel Stays reported consolidated revenue of INR 6619.26 Cr in FY19, with expenses of INR 8946.8 Cr leading to a loss of INR 2332.7 Cr. In the Y-o-Y comparison, revenue has grown 3.5X, with 3.8X jump in expenses resulting in 5.47X higher losses.

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19](https://inc42.com/wp-content/uploads/2020/02/Graphs-39.png)

In retrospect, it is notable that most of OYO’s fast-paced expansion happened in 2018, which has had an impact on its spending. So when we look at a consolidated level, many of its country-specific businesses were fresh off the ground in the reported period.

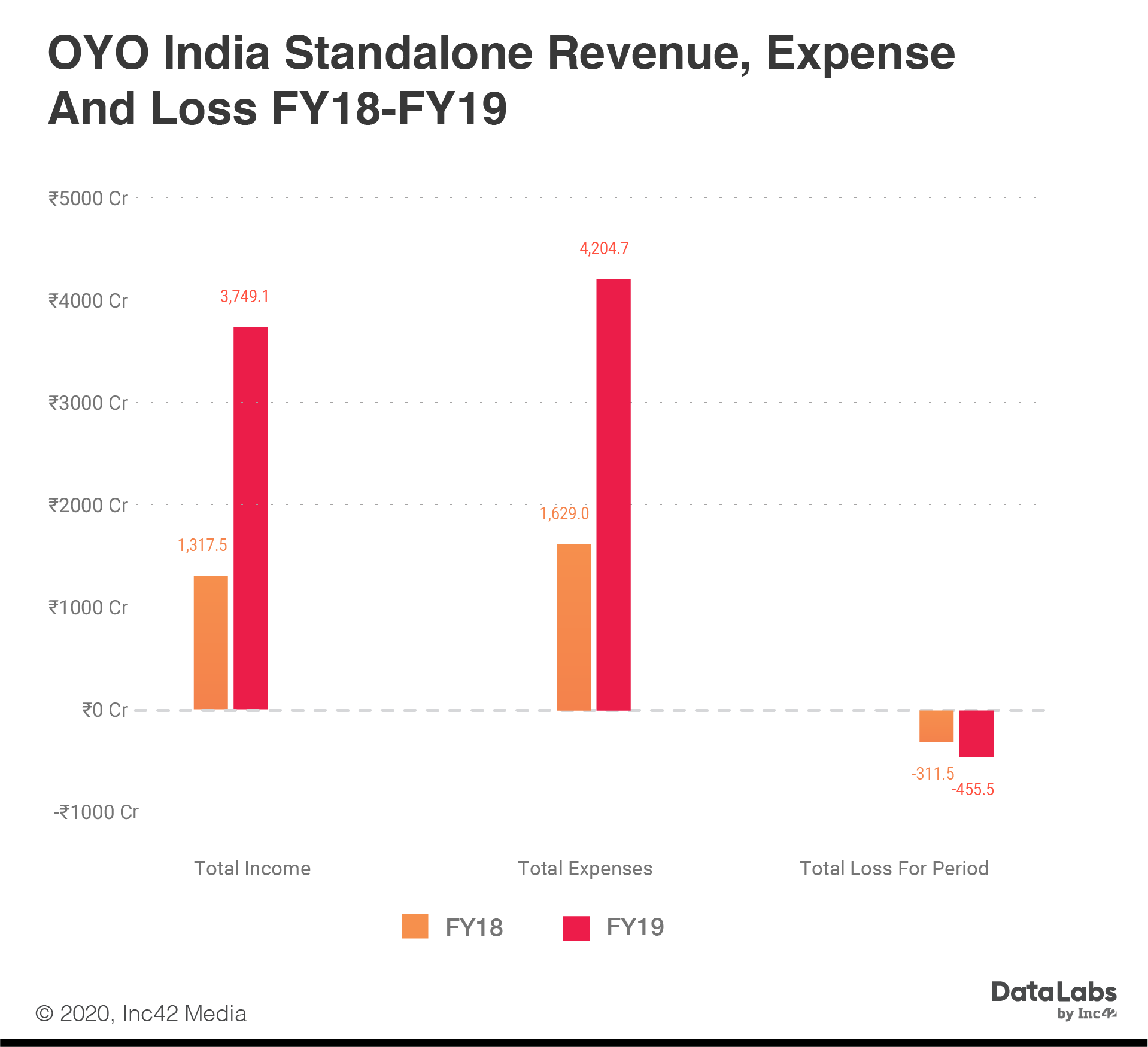

Putting that in context to markets where the company has long had a presence, we can see that OYO’s India operations earned INR 3749.13 Cr in FY19 with expenses of INR 4204.6 Cr leading to a loss of INR 455.5 Cr. In Y-o-Y comparison, the revenue has grown 1.84X, with 1.58X increase in expenses with a 46% increase in losses.

OYO Adds To Revenue Streams For Almost 2X Growth

Having started as a budget hotel aggregator, OYO has expanded into various hospitality segments from owned hotels to guest houses, vacation homes, serviced apartments, coworking and coliving spaces and events-related services. So it’s safe to say that it has multiple revenue streams.

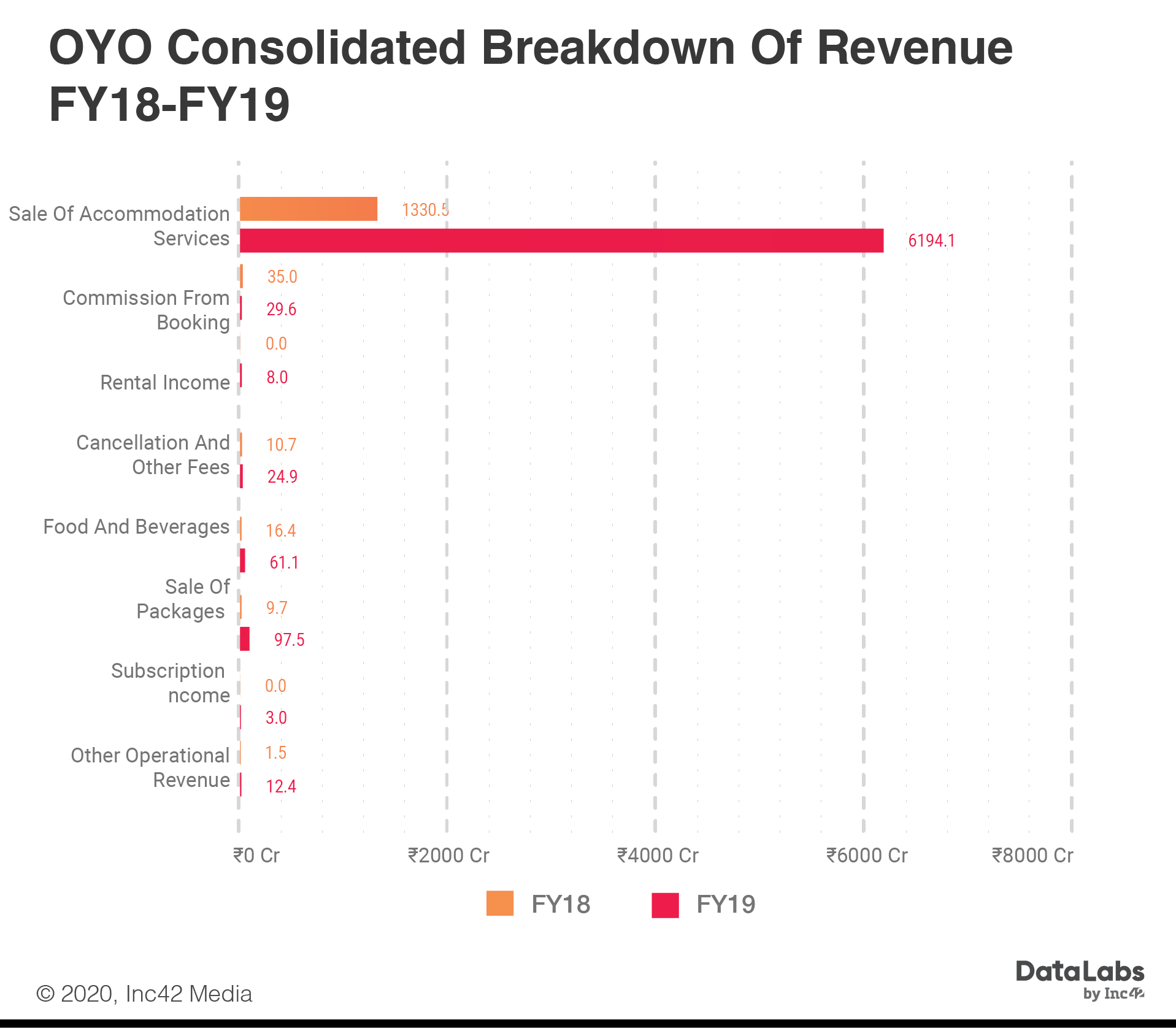

When we look at its standalone performance in India, the biggest source of revenue is the sale of accommodation services, which brought in INR 3399.65 Cr in FY19, a Y-o-Y increase of 1.83X from INR 1197.4 Cr in FY18.

The company is also earning through its performance-linked bonus income from hotel partners, which was INR 35.98 Cr in FY19, as against INR 3.7 Cr in FY18.

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19](https://inc42.com/wp-content/uploads/2020/02/Graphs-38.png)

On a consolidated level, OYO earned INR 6191.4 Cr from the sale of accommodation services in FY19, a 3.6X Y-o-Y increase. The company also saw a major jump in the revenue via the sale of packages worth INR 97.5 Cr, a 9X Y-o-Y increase.

Another new addition was subscription income worth INR 3 Cr in FY19, food and beverages revenue of INR 61 Cr in the year among others.

OYO’s Losses Down To Expansion Efforts?

In a media statement, OYO said that inherent costs of establishing new markets, including those related to talent, market-entry, operational expenses among others, resulted in an increase in OYO’s net loss percentage in the near-term.

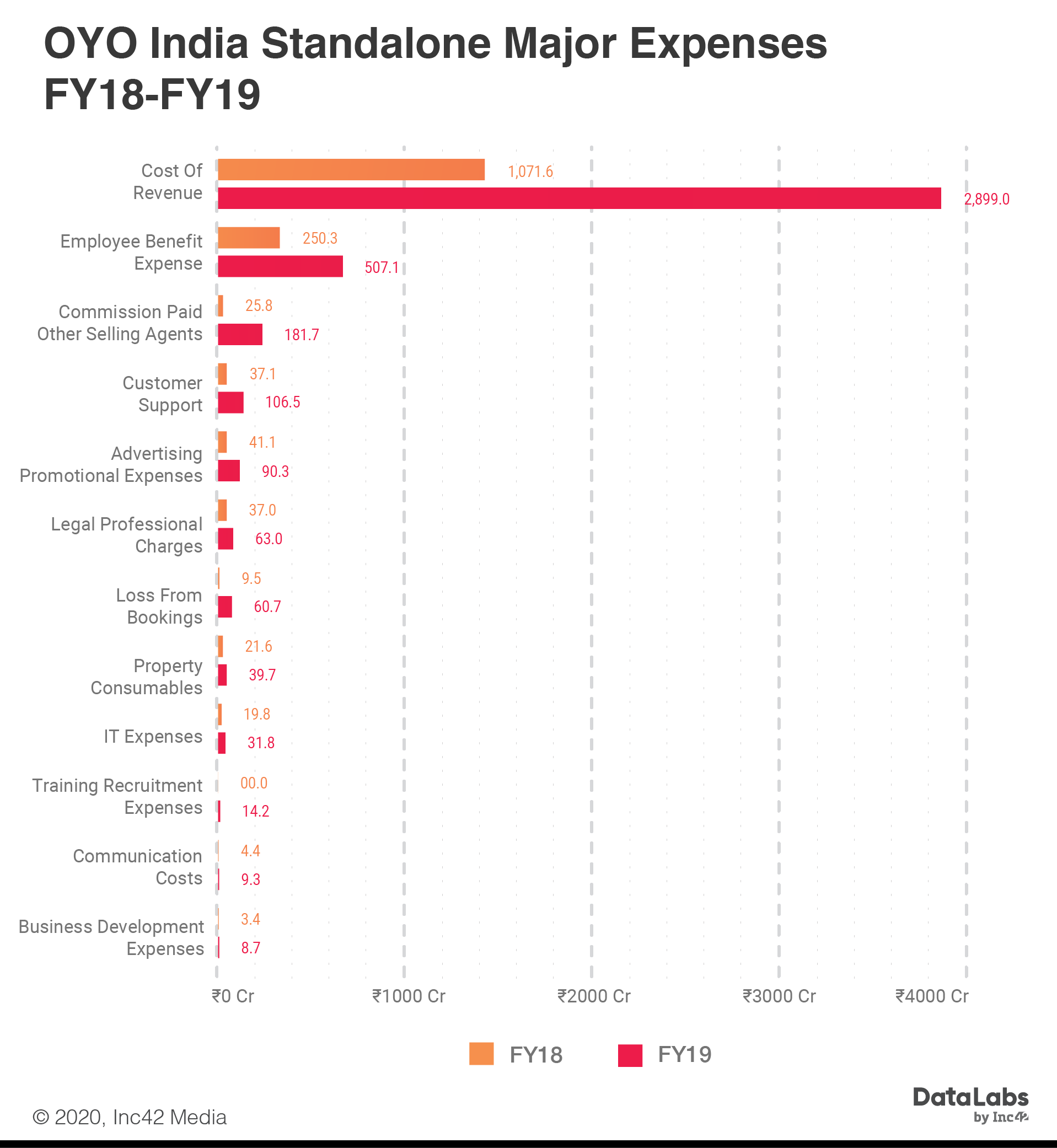

At the same time, it is a widely-known fact that for every international launch, OYO has gone hard on a hiring spree — it has over 12K employees in India alone, which reduced after mass layoffs in January 2020. As a result, in India and on a consolidated level, the bulk of OYO’s spending has been for employee costs.

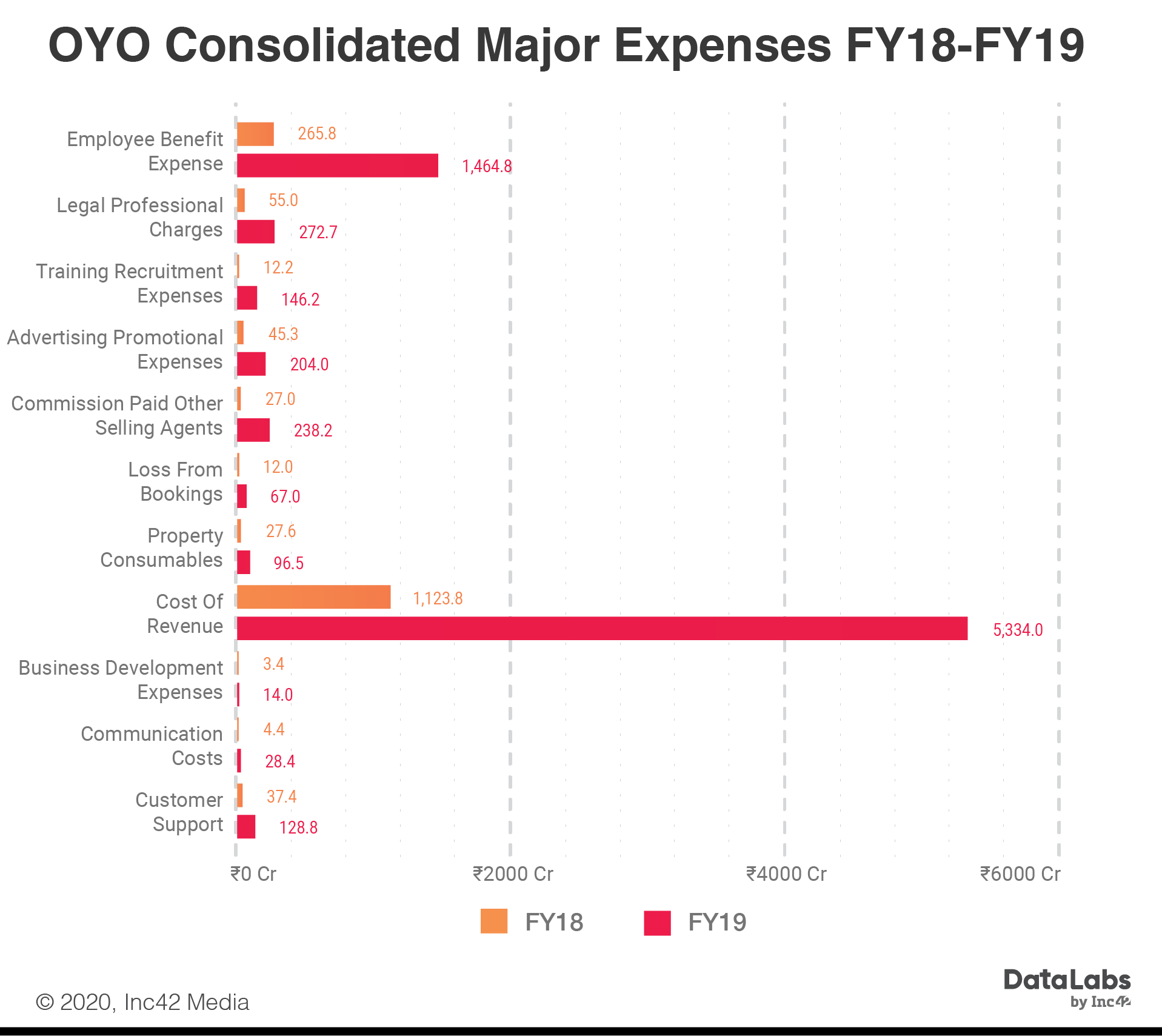

In India alone, OYO spent INR 507.1 Cr on employee benefits, 102% Y-o-Y increase from INR 250.3 Cr in FY18. On a global level, its consolidated employee benefits cost was INR 1464.77 Cr in FY19, a 4.5X Y-o-Y increase from INR 265.7 Cr in FY18.

Another interesting metric in the company’s filings was the cost of revenue. On a standalone basis for India, OYO burned INR 2899 Cr in FY19 on the costs of revenue, while on a consolidated level, cost of revenue was INR 5334 Cr.

Further, the company filings showed that OYO’s customer support costs were INR 1287.79 Cr in FY19 on a consolidated level while in India it was INR 1064.98 Cr for the year, a 1.86X Y-o-Y increase.

Which Markets Are Bringing In The Moolah For OYO?

The Ritesh Agarwal-led company claims to have 43,000 hotels with over 1 Mn rooms, with operations in over 800 cities in 80 countries, including the US, Europe, UK, India, China, Middle East, Southeast Asia, and Japan.

But time and again, OYO has emphasised that China is its second home ground. Even in a media statement today, OYO said that in FY 2019, it had a primary presence in China and India.

The company said that since China and other international markets were in development and investment mode during that time, launching these new operations contributed to 75% of the losses for FY19.

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19](https://inc42.com/wp-content/uploads/2020/02/Graphs-42.png)

When we look at the international breakdown of revenues and losses, China contributed a total income of INR 2134.4 Cr in FY19, while India brought in the total income of INR 4199.98 Cr.

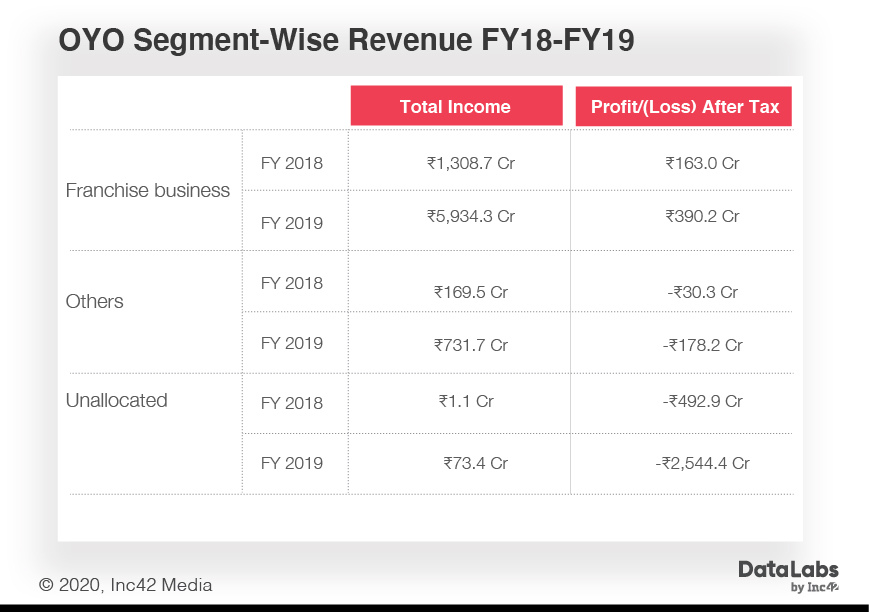

OYO has multiple streams of revenue and therefore its expenses are also diversified. The breakdown indicates primary spending areas such as the franchise business which provides hotel bookings, while other expenses include the spending for self-operated business, packages, weddings, conferences and events services.

What Changes In FY2020 For OYO?

Ahead of the financial year closing for 2020, the company has restructured its businesses to focus on self-operated businesses. Reports had surfaced that SoftBank has given OYO deadline of March 31, 2020, to phase out contracts/businesses, which are not EBITDA-profitable.

The company reportedly has a deadline of March 2020 to post positive EBITDA for its self-operated hotels and July 2020 as the deadline for positive EBITDA of its ancillary businesses.

It is to be noted here that OYO’s self-operated businesses include OYO Townhouse, Silverkey, Collection O, OYO Flagship and OYO Homes, etc. These include over 800 properties, where the company makes investments through leasing arrangements with the property owners. Ancillary businesses include Weddingz.in, which it acquired in 2018 among others. The idea here is to shut down ancillary businesses that do not report an operating profit before end-July 2020.

OYO chief Agarwal believes that the company is going through its most important phase as it looks to supplement its strong business plans with an uncompromising commitment to building an employee-first culture, with significant investment in continually improving its governance framework. Will this pay off in 2020?

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19](https://asset.inc42.com/2020/02/wtf-oyo.jpg)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/featured.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/academy.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/reports.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks5.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks6.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks4.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks3.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks2.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/perks1.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/readers-svg.svg)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter5.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter4.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter3.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter2.png)

![[What The Financials] Everything That Led To 5.4X Increase In OYO’s Losses For FY19-Inc42 Media](https://cdn.inc42.com/wp-content/uploads/2023/09/twitter1.png)